Dollar exchange rate long-term forecast. Analysis of the US dollar exchange rate for three months according to the Central Bank of the Russian Federation. What determines the dollar exchange rate, factors influencing exchange rates

Ufa analysts named the most profitable shares of recent trading ... sales. Free cash flow decreased by 27% - to 998 million dollars USA, which reflects a decrease in EBITDA and an increase in cash flows... - 6.88 million barrels per day,” noted the interlocutor of RBC Ufa. Dollar ended the trading session in different directions relative to major world currencies against the backdrop of the corporate reporting season. The ruble did not show uniform dynamics relative to dollar and the euro due to lower oil prices. Video 1... The dollar exchange rate fell below 64 rubles. for the first time since late September ...., follows from the data of the Moscow Exchange. During trading, the exchange value dollar fell to 63.91 rubles, which is 0.16% less... amounted to 64.075 rubles. Last time cheaper than 64 rubles. dollar turned out to be on September 25, dropping to 63.99 rubles. Euro exchange rate... closing of previous trading - 70.97 rubles. The rate officially set by the Central Bank dollar on October 17th increased compared to yesterday and... Putin called “another big mistake” in the use of the dollar in the world ... "Russian Energy Week", reports RBC correspondent. "We see attempts to use dollar as a political weapon. I think this is another very big mistake,” the head of state said. According to him, dollar has always enjoyed great confidence and was considered a universal means of payment. US sanctions policy restricting settlements in dollars, in turn, undermines confidence in this currency, the president added... The hryvnia exchange rate fell sharply after Zelensky's visit to the National Bank of Ukraine ... increased immediately by 35 kopecks, the exchange rate on the interbank foreign exchange market dollar The National Bank of Ukraine (NBU) grew by more than 1% sharply... hryvnia. In accordance with the decision of the regulator, on October 1, the official exchange rate dollar was immediately increased by 35.78 kopecks. (from 24.197 ... on the interbank foreign exchange market. During trading on Tuesday, the rate dollar reached 24,644 hryvnia, which is 1.3% higher...Finance, 30 Sep, 15:58

The dollar exchange rate rose above 65 rubles. for the first time since mid-September ... Well dollar According to calculations for tomorrow, it has risen above 65 rubles. for the first time since... the rate dropped below 65 rubles. for the first time since August 13th. Well dollar For the first time since August 13, it fell below 65 rubles. Euro exchange rate... in Saudi Arabia. As a result, for the first time in a month and a half, the course dollar fell below 64 rubles. The euro exchange rate then fell by more than...Economics, 15 Sep, 16:43

Aven recalled a dispute with a Washington Post reporter about dollars in Russia ... with a Washington Post journalist about the creation of ruble exchange points for dollars within six months. According to him, in addition to the foreign journalist... this is what will happen, what you can go change dollars" The deputies laughed in response, and one even called him crazy... that “if everyone could go, give rubles and get dollars, That dollars will not be enough". What seems obvious now did not seem...Finance, 12 Sep, 13:36

The dollar exchange rate fell below 65 rubles for the first time since August 13. Well dollar on the Moscow Exchange for the first time since August 13, fell below the mark... exchange data. During trading, the exchange value dollar fell to 64.95 rubles. Well dollar calculations “tomorrow” at 13:07 Moscow time decreased...Finance, 03 Sep, 14:36

The dollar exchange rate exceeded 67 rubles for the first time in two weeks. ... the maximum price of the American currency reached 67,085 rubles. Official rate dollar as of September 3, set by the Bank of Russia, is 66.62 rubles, euro - 73.17. Last time course dollar exceeded the mark of 67 rubles. August 19, and before that - only... February. At the end of August, the Ministry of Economic Development named the only option for increasing prices dollar up to 70 rub. - according to the department’s calculations, the rate may rise to... The US Treasury has abandoned dollar interventions The United States does not intend to weaken yet dollar. Trump previously complained about competitors' attempts to take advantage of the situation for political reasons... responded to speculation about possible US attempts to weaken the exchange rate dollar. The reason for the rumors was, among other things, Trump’s message... as follows: “Very strong dollar, very weak Fed." Earlier, Trump himself expressed concern about the strengthening dollar in relation to the currencies of countries... The head of the Central Bank of England proposed replacing the dollar with a new reserve currency ... dependent on the American economy, the role of emerging markets is growing, and the use dollar carries a risk, Mark Carney said. At a meeting with the heads of central banks of other countries, he proposed replacing the American currency. Dollar in the current situation has a destabilizing effect on the world economy. From... USA in the American city of Jackson Hole. Carney stated that dominance dollar in the global financial system has increased the risk of a liquidity trap in ultra-low interest rates... The Central Bank set the official euro exchange rate at a level below 73 rubles. ... will be 72.83 rubles. At the same time, the Central Bank also lowered the exchange rate dollar on August 23 - from 66.26 rubles. up to 65.61... . The cost of the currency was 72.97 rubles. In turn, the course dollar was 65.8 rubles. On August 15, the ruble exchange rate continued to decline... the euro exchange rate exceeded 74 rubles. Moreover, on August 19 dollar cost more than 67 rubles. Director of the analytical department of Loko-Invest Kirill... The euro exchange rate dropped below 73 rubles for the first time in a week. ....97 rub. At the opening of the exchange the rate was 73.605 rubles. Dollar by closing was at 65.8 rubles, the minimum... euro of the Central Bank on Thursday, August 22, is 73.4 rubles, dollar- 66.2 rub. The ruble is one of the most volatile currencies in the world... The Central Bank again increased the exchange rate of the dollar and euro ... set at RUB 73.94. At the same time, the rate continues to rise dollar, which increased from 65.99 to 66.6 rubles, follows from... . On Monday, August 19, during trading on the stock exchange, the exchange rate dollar for the first time since February exceeded 67 rubles. The dollar exchange rate exceeded 67 rubles for the first time since February. ... the crisis in Argentina provoked the flight of investors from emerging markets. Well dollar exceeded 67 rubles: at 14:15 Moscow time it was trading at... on Friday it closed at 73.74 rubles). Last time dollar cost more than 67 rubles. February 14, 2019. At first... The dollar exchange rate exceeded 66 rubles for the first time since the beginning of May. ...decrease in world oil prices. After 18:00 Moscow time course dollar for the first time since the beginning of May 2019, it rose above 66 rubles. At maximum cost dollar reached 66.085 rubles, which is 1.155 rubles... .78% higher than the closing level of previous trading. Last time more expensive dollar on the Moscow Exchange was on May 3, when its price rose... The ruble dipped against the dollar and the euro amid falling oil prices Dollar rose in price against the ruble by 70 kopecks, the euro - more... tariffs for China. The ruble exchange rate is losing ground against dollar and the euro following a decline in Brent oil prices... The ruble fell in price at the beginning of trading on the Moscow Exchange ... rose against the ruble on the Moscow Exchange. At the maximum dollar reached almost 65.32 rubles, and the euro - more than 73 rubles. The day before the close of trading dollar cost 64.93 rubles, and the euro - 72.54 rubles. Investing notes that, as of 11:17 Moscow time, dollar grew by 0.6%. At the same time, the euro added 0.64 ... exceeded $60.25 per barrel. In this regard, the course dollar decreased to 65.08 rubles. by 74 kopecks, and a euro... The ruble recovered its fall following oil prices ... $60 per barrel. The ruble won back more than the ruble against the euro, dollar- more than 70 kopecks. The price of Brent oil exceeded $60... August. Against this background, the ruble strengthened against major currencies. Well dollar to the ruble on the Moscow Exchange by 17:30 Moscow time according to... according to reserves, in the coming days the quotes may add a few more dollars. Well dollar will fall below 65 rubles, says Promsvyazbank chief analyst Bogdan... The Argentine peso collapsed after the defeat of the country's president in the primaries ... by 19% relative to the opening of trading). By 17:40 Moscow time course dollar to the Argentine peso increased relative to the beginning of trading by 29.29... on Friday it closed at 45.25 pesos per dollar. Fernandez, who was nominated in tandem with ex-President Cristina Fernandez... of the United States and China, as well as its consequences for the oil market. Dollar as of 17:40 Moscow time was trading at 65.62... The Central Bank announced a $19 billion foreign exchange cushion created by banks By the middle of the year, banks had accumulated currency reserves of almost $19 billion, the Central Bank reported. They will be able to use them when volatility in financial markets increases. The foreign exchange liquidity buffer of the banking sector reached $18.7 billion as of July 1, 2019 - this is comparable to the highs observed in previous years, the Central Bank notes in its “Review of Financial Risks... The ruble has risen in price against the dollar and euro Well dollar at the opening of trading on the Moscow Exchange decreased compared to... .09 rub. On Monday, August 5, at 19:30 Moscow time dollar weakened to 65.2 rubles. (trading on Friday... The euro exchange rate exceeded 73 rubles. ...cutting the Fed rate. The euro exchange rate on Monday, in contrast to dollar, continued to strengthen against the ruble, reaching its highest since mid-June. For... major currencies, it is due to the fact that the euro is significantly becoming more expensive dollar, notes Promsvyazbank chief analyst Bogdan Zvarich. Euro on global markets... Chief Economist of Nordea Bank Tatyana Evdokimova. Euro strengthens as it falls dollar, senior analyst of BCS Premier Sergei Suverov notes: US President... The ruble strengthened after US clarification on the scope of new sanctions ... the introduction of new US sanctions. As of 10:20 Moscow time dollar is trading at 65.06 rubles, despite the fact that at the time of closing... the rate was 65.27 rubles. Although trading opened with strengthening dollar, by 10:14 Moscow time the American currency even briefly fell below 65 rubles. (on Friday dollar broke this mark for the first time since June). Then dollar recovered the fall, returning to the level above 65... The dollar and euro rose by half a ruble in an hour after Trump's tweet ... September, oil prices fell and exchange rates rose. Well dollar on the Moscow Exchange increased by 43 kopecks in an hour, the euro... kopecks, it follows from the trading data. At 20:00 at minimum dollar traded for 63.82 rubles, the euro - for 70.62 rubles... 60 kopecks. (RUB 71.19), dollar- by 63 kopecks. (RUB 64.25). At the end of the day dollar increased growth to 77 kopecks, euro... Sberbank has improved its forecast for the ruble exchange rate for 2020 ... the ruble against the American currency will be 69 rubles. behind dollar, then now the bank has adjusted it to 65 rubles. Sberbank has improved... the ruble for the next year from 69 to 65 rubles. behind dollar. This is evidenced by data from materials (.pdf) of the credit institution. According to... . The previous forecast was at 65 and 66 rubles. behind dollar respectively. A key role in changing the forecast then was played by a change in external... The dollar's share of payment for exports from Russia to China fell below 50% for the first time. Why countries are switching to payments in euros and not in national currencies ... and the Central Bank. Russia still mostly pays for Chinese imports dollars(66.5%). China is Russia's largest trading partner among states, its... information about whether they have transferred part of their contracts from dollars In Euro. "Gazprom", NOVATEK, "Gazprom Neft", "Rosneft", "Surgutneftegaz" and LUKOIL... the observed decrease, in settlements with the main trading partners of Russia, the share dollar is still very high, states the head of monetary analysis... Sberbank has improved its forecast for the ruble exchange rate. Softening rhetoric by the US Federal Reserve plays into the hands of the Russian currency ... . The previous forecast was at the level of 65 and 66 rubles. behind dollar respectively. The key role was played by the change in the external background, Lisovolik explains: more... This soft rhetoric has increased expectations of a Fed rate cut in July: dollar began to become cheaper, the currencies of emerging markets began to rise in price. On Thursday, the ruble continued... for years, says the chief economist of the investment bank, Alexander Isakov. By the end of the year dollar will be higher than 65 rubles, says Raiffeisenbank analyst Denis Poryvay: influx... The dollar exchange rate at the opening of trading fell below 63 rubles. Well dollar to the ruble at the opening of trading on the Moscow Exchange amounted to 62.995....5 kopecks. compared to the closing level of previous trading. Price dollar at the close of the previous trading day it was 63.18 rubles. Exchange rate... rub. Earlier, on July 10, it was reported that the ruble began to grow towards dollar and the euro after the speech of the Chairman of the US Federal Reserve Jerome... The dollar fell to its lowest level since the beginning of the year ... key rate. At trading on the Moscow Exchange on Thursday, the rate dollar immediately dropped to 63.26 rubles. Closing price of the previous... Fed statements began to transfer money from dollars and US Treasury bonds in shares, the TV channel noted. Decline dollar- largely the result of the Fed's decision... lowering the Fed rate and the risks of its reduction at the next meeting. " Dollar is rapidly losing ground against major world currencies, this automatically strengthens...For residents of Russia and CIS countries USD/RUB exchange rate is of very great importance. Turbulence on the foreign exchange market leads to a significant rise in prices for goods and services, which was most clearly observed in 1998, 2008 and 2014. Strong volatility, followed by long-term periods of stability, allows speculators to make money both on the trend and on sideways movements.

USD RUB exchange rate now on the exchange (online) - Live Chart

The USD/RUB chart works online and provides the opportunity to connect and also conduct your own manual analysis using special additional tools.

Due to increased volatility, this instrument is popular among speculators. After the 2014 crisis, it overtook futures in popularity and became the most popular instrument in the domestic market. USD/RUB chart shows strong and distinct movements that are easily analyzed using popular technical indicators.

USD/RUB forecast for today

The USD/RUB forecast is constantly updated, so keep an eye on the update date. The USD/RUB forecast compiled on the basis of technical indicators and has varying degrees of signal strength. We recommend paying attention only to the values Active buy And Actively sell, and the best situation will be when these values are repeated on all timeframes.

General characteristics of USD/RUB

The USD/RUB currency pair is called exotic in the world and is not very popular. This is due to the fact that the Central Bank regulates the ruble exchange rate, and traders consider the Russian economy to be unstable and the currency risky, and also, key news on RUB is published in Russian, which few people in the world know.

Active trading takes place during the trading session of the Moscow Exchange, and after it closes, trading practically stops. Many brokers prefer to close trading before 8 am so that the USD/RUB chart has a more pleasant appearance and is easier to technical analysis.

The USD/RUB pair has a standard lot of $100,000 per . Brokers provide fractional lots, allowing you to trade quotes starting with a sell or buy of $1.

The USD/RUB pair has a standard lot of $100,000 per . Brokers provide fractional lots, allowing you to trade quotes starting with a sell or buy of $1.

- If you predict dollar growth- you need buy quotation.

- If you predict ruble growth- you need sell quotation.

Despite the fact that the history of the quote began in 1991, only in the last couple of years have brokers begun to add it to their list. Previously, such an asset was rare.

What affects the USDRUB exchange rate?

The dollar/ruble pair is strongly influenced by monetary policy Central Bank RF and Fed USA. Raising the key rate in Russia leads to a depreciation of the American currency. In turn, the American government’s raising of rates leads to a strengthening of the US dollar against other banknotes, including the ruble.

The release of news from America has a stronger impact on the USD/RUB exchange rate.

There is a belief that ruble quotes directly depend on. If oil rises, then the dollar begins to decline against the ruble and vice versa - a fall in hydrocarbon prices leads to a decrease in demand for the Russian national currency. This is not entirely true. If you pay attention to the fall in oil during the globalfinancial crisis of 2007, you can notice that the ruble has fallen, but has not collapsed, as happened in 2014. Currently, the ruble/dollar ratio is largely determined by international risk appetite. The ruble, like commodity instruments, is a risky instrument. Accordingly, when large market participants show interest in venture investments, both oil and the ruble begin to rise, and vice versa.

Indirectly, the USD/RUB exchange rate also depends on the euro, since if the European currency falls, then, accordingly, the dollar strengthens, and not only against the euro, but also against other currencies, including the ruble.

The ruble exchange rate in the Russian Federation is manageable and regulated, which greatly reduces the attractiveness of many market players. In general, the USD/RUB currency pair is influenced by many economic news - GDP, unemployment, interest rates, consumer sentiment and so on, but the Central Bank tries to prevent strong jumps and smoothes the rate through its actions.

The ruble exchange rate in the Russian Federation is manageable and regulated, which greatly reduces the attractiveness of many market players. In general, the USD/RUB currency pair is influenced by many economic news - GDP, unemployment, interest rates, consumer sentiment and so on, but the Central Bank tries to prevent strong jumps and smoothes the rate through its actions.

What is the best way to trade the USD/RUB currency pair (+example)

The price dynamics of USD/RUB allows you to implement both long-term and short-term speculative strategies. Using the simplest price channels with an adequate interval brings tangible returns already on 2- and 3-month trading sessions. In the long-term medium term (from a month or more), it is recommended to work only for growth, excluding short positions. This is due more to the macroeconomic situation than to objective technical indicators.

- Holding a short dollar position for a long time will mean that you are going against the Central Bank of the Russian Federation (which benefits from a cheap ruble) and the position of the United States (sanctions are a fundamental factor in the issue of ruble devaluation), which is not very reasonable.

It would be advisable to open trades when the price channel is broken with an interval of 20 on the daily chart. As a stop, you can use the lower border of the channel, or a fixed order of 6% with periodic pulling it up to the current price.

On 15-minute periods it is convenient to use 150 or 160 intervals. By reducing the time interval, it will be possible to open short positions. Thus, breaking through the channel downwards means a reversal into shorts, and breaking through upwards means into longs. These same lines are stops in a situation when the price goes against the trader. The size of the transaction should be calculated based on such proportions that it is impossible to lose more than 4% from the current entry point.

On 15-minute periods it is convenient to use 150 or 160 intervals. By reducing the time interval, it will be possible to open short positions. Thus, breaking through the channel downwards means a reversal into shorts, and breaking through upwards means into longs. These same lines are stops in a situation when the price goes against the trader. The size of the transaction should be calculated based on such proportions that it is impossible to lose more than 4% from the current entry point.

- You can also use an adaptive price channel on USD/RUB, which can automatically select the required interval.

Among the most profitable tools for earning money are . In addition to high profits, this tool is very simple and accessible.

To make money on binary options, you just need to determine the direction of the price. That is, here it doesn’t matter to us how much the price changes, it only matters whether it goes up or down, even if it’s just one point.

Instead of 1000 words, we will show with an example how it goes trading in USD/RUB from a reputable and regulated broker.

After a little analysis we decided that USD/RUB exchange rate will grow, and the USD/RUB forecast confirmed this. We opened and selected the desired asset:

Then, in the transaction settings, specified the transaction period:

The option will close at 14:30, in 19 minutes. It remains to indicate whether the price will be higher or lower at the time the transaction is closed relative to the quote at the time the option was purchased. We predict a fall according to the trend and press the button DOWN:

If after 19 minutes, at the time of closing the transaction, the USD/RUB rate is lower than at the time of purchase, our option condition will be fulfilled, and we will receive 65% profit.

We didn’t have to wait long, and here are the results of the deal:

The graph shows how the value of the dollar fell against the ruble, our forecast came true, and we returned $132, of which $52 was net profit:

Features of the USDRUB currency pair

Due to the tense economic situation in the Russian Federation, the country's population has traditionally used the US dollar and other reserve currencies as the only available way to save money. Thus, the next budgetary difficulties may cause an increased demand for dollars among the population. The load on bank exchangers causesincreased demand for deliverable foreign exchange contracts on the exchange itself. During such periods, banks widen the bid-ask spread. Thus, those people who are not familiar with the foreign exchange markets have to buy dollars at a huge premium. In particular, on the eve of 2016, the difference in banks was more than 11 rubles.

If you find an error, please highlight a piece of text and click Ctrl+Enter.

The official dollar exchange rate of the Central Bank of the Russian Federation in Russia today, October 28, 2019, 17:53, is 63.9966 rub. (1 USD = 63.9966 rubles). The Bank of Russia dollar exchange rate for tomorrow, October 29, 2019, is set at 63.87 rub. Below on this page you can see a graph of the dynamics of the dollar exchange rate to the Russian ruble (USD/RUB) for a week, a month, a quarter, for a year and for all time, find out the exchange rate for a given date, and also find out when, how and why the Central Bank sets the official rate.

Dollar exchange rate of the Central Bank of the Russian Federation for today, October 28, 2019 (Monday): 63.9966 rubles.

The official dollar exchange rate of the Bank of Russia for today, October 28, 2019, 17:53, is 63.9966 rub. Compared to the previous working day, the Central Bank increased the dollar exchange rate in Russia by 0 rub. (0%).

Dollar exchange rate of the Central Bank of the Russian Federation for tomorrow, October 29, 2019 (Tuesday): 63.87 rubles.

The official dollar exchange rate of the Bank of Russia for tomorrow, October 29, 2019, is 63.87 rub. Compared to the previous working day, the dollar exchange rate was reduced by -0.1266 rub. (-0.2%).

Dynamics of the dollar exchange rate in Russia - Graph

The minimum value of the dollar exchange rate according to the Central Bank of the Russian Federation in 2019 was 62.5229 67.192 rub. Since the beginning of the year, the dollar exchange rate has strengthened by 3.0829 rub. (4.82%).

The minimum value of the dollar exchange rate according to the Central Bank of the Russian Federation for the current month was 63.6336 rub., maximum value - 65.4399 rub. Over the month, the US dollar rose against the Russian ruble by 0.6441 rub. (1.01%).

Archive of the dollar exchange rate of the Central Bank of the Russian Federation for the selected date

In this table you can see the dynamics of the dollar exchange rate in Russia by day for a given date.

When and how does the Central Bank set the official ruble exchange rate?

The Central Bank sets the US dollar/ruble exchange rate for tomorrow every weekday. The established rate begins to be effective on the next calendar day after the day of establishment and remains in force until the next established rate comes into effect. The data is published on the regulator’s website until 15:00 Moscow time (usually this happens around 14:00)

Let's look at an example: on Tuesday, the Bank of Russia set the dollar exchange rate for Wednesday. This is the dollar exchange rate for tomorrow. In this case, on Tuesday, the rate for today is the rate set on Monday. On Wednesday, the rate for today becomes the rate set on Tuesday, and the rate for tomorrow (Thursday) is published on Wednesday at around 14:00 Moscow time.

A separate logic applies on weekends and holidays. So, on Friday, the Central Bank of the Russian Federation sets the exchange rate for tomorrow, which is valid on Saturday, Sunday and Monday. The new rate for tomorrow will be published only on Monday afternoon and will come into force on Tuesday. A similar logic applies to holidays.

How is the Central Bank exchange rate formed? To do this, the regulator averages quotes for the USDRUB pair in trading on the currency section of the Moscow Exchange during the index session (from 10:00 Moscow time to 11:30 Moscow time). Then, based on the dollar exchange rate, the Bank of Russia forms the official rates of other 33 currencies. The exchange rate of the ruble depends on supply and demand in the market.

Why do we need the official dollar exchange rate, since it quickly becomes outdated and does not “keep up” with the real dynamics of the foreign exchange market? It is a standard for government agencies when preparing reports, and also serves as a convenient reference point for people who are far from the world of stock exchange news.

Average monthly dollar exchange rate of the Central Bank of the Russian Federation 2017, 2018, 2019

The average dollar exchange rate according to the Central Bank of the Russian Federation for the current year is 64.8794 rubles. The average dollar exchange rate for the current month is at the level of 64.4247 rubles.

The question of what will happen to the dollar in the near future worries not only economists, but also ordinary citizens. This interest is due, first of all, to the fact that Russia’s economic stability largely depends on the exchange rate of the American currency against the domestic ruble.

This dependence is determined by many external and internal factors, the main of which are the price of oil and gas on the world market, as well as currency quotes on the stock market. What forecasts do experts make regarding the US dollar for 2018, let's try to understand this review.

What is the dollar exchange rate trend in the near future?

In 2017, the exchange rate of the American currency strengthened significantly. This was influenced by several events at once:

- House approval of tax reform passed in the Senate on December 19 last year;

- increase in the Federal Reserve System (FRS) rate;

- implementation of the Federal Reserve project aimed at reducing the dollar supply;

- US President Donald Trump signing a bill to ease the taxation of citizens.

In addition, European countries have recently experienced an economic decline associated with a crisis within the conglomerate (the intentions of some states to leave the European Union have been announced), increased unemployment, and the influx of a large number of Muslim refugees from the warring powers. All this contributes to the depreciation of the euro and at the same time the strengthening of the dollar in the global financial market.

Dollar exchange rate forecast for the first quarter of 2018

As the demand for the dollar supply in the world continues to increase, the United States currency will only strengthen in the near future. This is exactly the forecast made by authoritative international experts for the spring of 2018. As for the dollar-ruble ratio, the main influencing factor here is considered to be the price of oil, since Russia is one of the largest suppliers of “black gold” in the world.

Predictions for this spring based on forecasts of leading stock analysts (the estimated value of 1 dollar in rubles is indicated):

- March - 58.35

- April - 59.87

- May - 61.23

At the same time, some experts predict that with the victory of V.V. Putin in the presidential elections on March 18, 2018, the growth of the domestic currency or its stabilization is also possible. The near future will show which financier was right.

Expert forecast for summer 2018

Economists' opinions regarding the RUB/USD pair exchange rate for the summer of 2018 are divided:

- Some experts predict the quotation of the domestic currency at a level not exceeding 56 rubles. for a dollar.

- Other experts say that the US currency exchange rate in the summer will fluctuate in the range from 57 to 62 rubles.

By month it might look like this (the estimated cost of 1 dollar in rubles is indicated):

- June - 61.89

- July - 62.93

- August - 60.88

Dollar exchange rate forecast for autumn 2018

The forecast for the fall for the Russian currency in relation to the American currency will largely depend not only on the price of oil and gas, but also on how productive this season will be. Economic analysts make the following predictions for this period (the estimated value of 1 dollar in rubles is indicated):

- September - 62.98

- October - 61.25

- november

$ exchange rate at the end of 2018

The end of 2018 will be marked by the following important financial events.

The official dollar to ruble exchange rate set by the Central Bank of Russia for tomorrow.

63.8700 RUB for 1 USD

Change of course

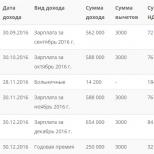

Latest values

| 2019-10-29 Tue | 63,8700 | −0,1266 | −0,20% | |

| 2019-10-28 Mon | 63,9966 | 0,0000 | 0,00% | |

| 2019-10-27 Sun | 63,9966 | 0,0000 | 0,00% | |

| 2019-10-26 Sat | 63,9966 | 0.1366 | 0.21% | |

| 2019-10-25 Fri | 63,8600 | 0.0603 | 0.09% |

Dollar exchange rate in other central banks

| National Bank of the Republic of Belarus | 1 USD | 2.0471 BYN |

Ruble to dollar exchange rate for tomorrow

The Central Bank of the Russian Federation determines the official dollar exchange rate for tomorrow based on information on the weighted average dollar exchange rate at trading on the Moscow Currency Exchange, received for the current day at 11:30 a.m. Moscow time. This is enough to get a dollar exchange rate forecast for tomorrow.

The Central Bank of the Russian Federation uses the weighted average dollar exchange rate for calculations “for tomorrow” from the opening of the Moscow Exchange until 11:30 (USD/RUB - TOD). The Bank of Russia checks dollar quotes from the stock exchange and issues an order “On Foreign Currency Rates,” which sets the official dollar exchange rate for tomorrow.

On this page, the Central Bank dollar exchange rate for tomorrow appears immediately after the official publication by the Bank of Russia - every working day after 12 noon.

The new official dollar exchange rate of the Central Bank of the Russian Federation begins to operate on the next day after the order is signed and becomes the official USD exchange rate of the Central Bank of Russia until the next order is issued.

Thus, the Bank of Russia order signed on Friday will determine the dollar exchange rate for the next three days: Saturday, Sunday and Monday. On Monday, the next online dollar trading will take place on the stock exchange and the exchange rate for Tuesday will be determined. Likewise for other days of the week.

During weekends and holidays, the dollar exchange rate does not change.